suppliers and creditors of a firm are interested in ,Differences between supplier and creditor ,suppliers and creditors of a firm are interested in, External stakeholders are business stakeholders who are outside the organization. They do not have ownership or work relations in the company. In other words, they are those . But the truth is, I absolutely love the Explorer range (1 and II) as well as the Sub (especially the no date). And I feel it would be great to have at least one Rolex in my collection .

In the complex ecosystem of business, external stakeholders play a critical role in ensuring the smooth functioning of a firm. Among these stakeholders, suppliers and creditors are two key groups that are particularly focused on the financial health and stability of a company. These external parties are crucial to a firm's operations, providing necessary goods, services, and funding to keep the business running. However, their involvement goes beyond merely providing products or capital—they are also deeply concerned with the firm's ability to meet its financial obligations.

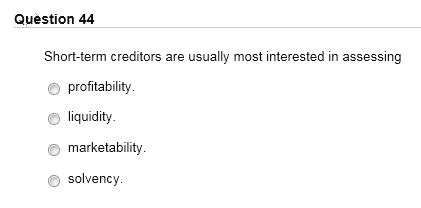

One of the main ways suppliers and creditors assess the financial viability of a firm is through financial ratios, particularly liquidity ratios. These ratios provide a snapshot of a firm's ability to meet its short-term obligations, a key concern for those who rely on the firm to pay for goods, services, or loans. This article delves into the types of financial ratios that suppliers and creditors focus on, their differences, and the broader role they play in a firm's financial ecosystem.

1. The Role of Suppliers and Creditors in a Firm’s Financial Ecosystem

Before diving into the specific financial ratios, it is important to understand the distinct roles that suppliers and creditors play in a firm's operations.

- Suppliers: Suppliers are external entities that provide goods or services to a firm, often on credit. They are interested in ensuring that the firm can pay for the supplies it receives. Suppliers typically offer payment terms, such as 30, 60, or 90 days, during which the firm must settle its account. As such, suppliers are deeply concerned with the firm's liquidity, which indicates its ability to pay bills and meet short-term obligations.

- Creditors: Creditors, on the other hand, are individuals or institutions that lend money to the firm. This could include banks, bondholders, or other financial institutions. Like suppliers, creditors are concerned with the firm's ability to meet its short-term and long-term obligations. Creditors are more focused on the firm's overall solvency and the likelihood of getting repaid according to the terms of the loan agreement. While creditors are also concerned with liquidity, they often take a broader view, considering not just short-term obligations but also the firm's long-term financial health.

Both groups are essential to the firm’s operation, and they both depend on the company's ability to maintain financial stability.

2. Differences Between Suppliers and Creditors

While suppliers and creditors share common concerns about a firm's ability to pay its obligations, they differ in several key areas, such as the nature of their involvement, the financial risks they face, and the specific financial information they prioritize.

- Nature of Engagement:

- Suppliers are often more directly involved in the day-to-day operations of the firm. Their primary concern is the firm’s ability to pay for goods and services on time. Suppliers may have ongoing relationships with the firm and may offer credit terms to encourage continued business.

- Creditors are usually less involved in the operational aspects of the firm. Their relationship with the firm is often more transactional and formal, revolving around loans, bonds, or credit lines.

- Risk Exposure:

- Suppliers face the risk that the firm may not pay for goods or services supplied on credit, resulting in financial losses. If the firm’s liquidity is poor, suppliers may experience delays or defaults in payments.

- Creditors face a broader risk related to the firm’s overall solvency. A creditor’s concern extends beyond the firm’s ability to meet immediate obligations and includes the risk of the firm failing to repay long-term debts.

- Type of Information Sought:

- Suppliers are most concerned with liquidity ratios, as these directly indicate whether the firm will be able to meet its short-term obligations (e.g., paying for goods and services supplied on credit).

- Creditors may be more interested in a combination of liquidity ratios and solvency ratios, as they assess both the firm’s ability to meet short-term obligations and its long-term financial stability.

3. Liquidity Ratios: A Key Focus for Suppliers and Creditors

Liquidity ratios are essential for assessing a firm’s ability to meet short-term obligations. Both suppliers and creditors rely on these ratios to evaluate the risk associated with doing business with a firm.

# 3.1 Current Ratio

The current ratio is one of the most commonly used liquidity ratios. It is calculated by dividing a company’s current assets by its current liabilities:

\text{Current Ratio} = \frac{\text{Current Assets}}{\text{Current Liabilities}}

suppliers and creditors of a firm are interested in Trust, honesty, and transparent pricing. The Company offers the largest and finest selection of used, pre-owned, and vintage luxury watches from brands including Rolex, Omega watches, Tudor watches, Oris, Cartier watches, Panerai, Longines, Tissot, Breitling, Audemars Piguet, Patek Philippe, and more.It has become the ultimate destination for consumers looking to buy, .

suppliers and creditors of a firm are interested in - Differences between supplier and creditor